I have several sources of income from around the world-from my university position and my ed tech startup company BrainQuake fees from writing, speaking, and consulting royalties from books and more recently income from a number of pensions and annuities. Though by no stretch of the imagination am I in the big-income category, my tax-filing situation is not simple. Indeed, I spent several days in March going through my QuickBook records as I prepared my annual tax filing. Sure, I knew what double-entry book-keeping was. (I also gave a talk at a public showing Christie’s organized in San Francisco on April 24, which gave me an opportunity to examine the book myself.) Neither did I-until I was asked to write a brief article about the fifteenth century Italian mathematician Luca Pacioli, to go into the sale catalog for the upcoming (June) Christie’s auction of an original first edition of his famous book Summa de arithmetica, geometria, proportioni et proportionalita (“Summary of arithmetic, geometry, proportions and proportionality”), published in 1494, which I referred to in last month’s column. Keep visiting us over the next few weeks for more insights into the world of financial statements, and watch this space for our Financial Statements for Dummies book, coming soon.What’s your reaction when you see the term “double-entry book-keeping”? Do you associate it with cool, societal-changing innovations like the Internet, Google, social media, laptops, and smartphones? Probably not. So, in other words, all bookkeeping stems from the general ledger, and all financial statements start with entry bookkeeping.

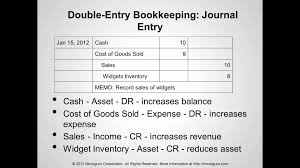

Each journal entry must be balanced by making sure that the credit and debit columns are always equal. These journal entries will show which general ledger accounts must be debited and credited. The general ledger will be booked with what are known as “journal entries”. The balance sheet, which records the assets, liabilities and equity capital.There are two types of general ledger accounts, both of which will be explored further in a later blog: Remember that double entry bookkeeping is completely different from the illegal practice of keeping two sets of books, when companies keep two accounting records in order to hoodwink the tax authorities. If the customer hasn’t paid, then the balance won’t come to £0 and you’ll quite easily be able to tell that there’s a problem.ĭouble entry bookkeeping is also useful in providing business owners with an up-to-date record of assets and liabilities. Then, when your customer pays the £500 that he owes, this will be entered into the credit column. The balance of the two columns should always be zero.įor example, if you’re selling a product for £500, then this should be inputted into the debit column. The idea is that by entering an amount into a debit column as well as one into a credit column, any mistakes are certain to be detected.

What is double entry bookkeeping?Īs its name suggests, double entry bookkeeping is when every figure entered into an account needs a corresponding and opposite entry. It was in the glory days of the Renaissance in the 15th century when Luca Pacioli, a mathematician often referred to as the grandfather of accounting, invented this simple yet ingenious process.

However, we need to travel to Italy, the birthplace of banking, to find the very first double entry bookkeeping system. Financial statements can be traced as far back as the ancient Egyptians, who wrote their accounts on papyrus scrolls, while the Babylonians preferred to carve their figures onto tablets made of clay. The history of double entry bookkeepingįinance and accounting today may be a very different beast from the time of the pharaohs, but keeping accounting records is arguably as old as civilisation itself. We’ll be breaking down the whole process from start to finish, beginning today with double entry bookkeeping, which forms the backbone of all financial statements. Over the next two weeks, we’ll be giving a masterclass in financial statements in advance of the launch of our Financial Statements for Dummies guide. Understanding financial statements can be a daunting process for many.

0 kommentar(er)

0 kommentar(er)